T-Mobile debuts 5G mobile hotspot

T-Mobile last week announced the availability of its first 5G-powered mobile hotspot device. The new Inseego 5G MiFi M2000 is a sub-6 GHz device that will run on T-Mobile’s low- and mid-band 5G spectrum and will power up to 30 devices with 5G Internet connectivity. The new device is complemented by new rate plans that start as low as $20/month (for 5GB of data). The following tiers are priced at $30, $40, and $50 and come with data caps of 10GB, 30GB, and a whopping 100GB, respectively. Notably, all of the aforementioned price points require AutoPay subscriptions. The Inseego 5G MiFi M2000 is being promoted with a 50% discount, bringing its price down to $168 (or $7/month for 24-months).

The NPD Take:

- T-Mobile might have been late to market with a 5G-powered mobile hotspot offering, but its value proposition beats that of rivals AT&T and Verizon, whose 5G mobile hotspots have been on the market for months. T-Mobile’s $50/100GB plan offers significant cost advantages over AT&T and Verizon’s standalone mobile device plans. On the other hand, we should note that both rivals offer unlimited data for hotspot customers as an add-on to smartphone plans ($20 add-on for AT&T and $30 add-on for AT&T).

- While T-Mobile’s press release does not mention a Test Drive initiative for the new 5G mobile hotspot, the carrier has long been offering prospects the ability to test its network via a mobile hotspot device for 30 days (or 30 GB of data, whichever comes first). The addition of the Inseego 5G MiFi M2000 hotspot to the Test Drive program should be highly beneficial as it would allow customers to experience T-Mobile’s mid-band 5G speeds (which the carrier claims to be between 300 Mbps and 1Gbps) before committing to a long term contract.

LG to outsource mid-tier mobile phones

LG Electronics last week announced its mobile phone business division has gone through a reorg that divested the development of low and mid-tier smartphones to outsourcing partners. The company also announced that it will eliminate and reshuffle some of its research & development and production positions as it shifts focus from low- and mid-tier models to premium handsets.

The NPD Take:

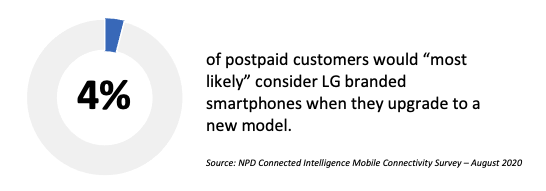

- LG’s global mobile phone business division has been operating at a loss for over five years (22 consecutive quarters to be exact) due to fierce competition from Chinese vendors, and the company hopes to turn the tables around by extending its ODM (original device manufacturer) relations beyond just the low-end smartphones. While this strategy may bear fruit in global regions, where Apple has relatively lower dominance, LG’s non-premium US positioning has no tolerance for error. LG is a distant number three behind Apple and Samsung in the US market, and it enjoys high market share numbers thanks to its strong low- and mid-tier models that are quite popular among prepaid customers.

- LG previously has decided to fork its device business to two separate lines; the Universal Line, which focuses on mainstream designs such as the Velvet, and the Explorer Project, which goes after the niche market with innovative products such as the Wing dual-screen phone. The decision to outsource the low-margin products should help LG to concentrate its full focus on the high-margin premium segment and build competitive flagships products that can go up against Samsung’s Galaxy series.